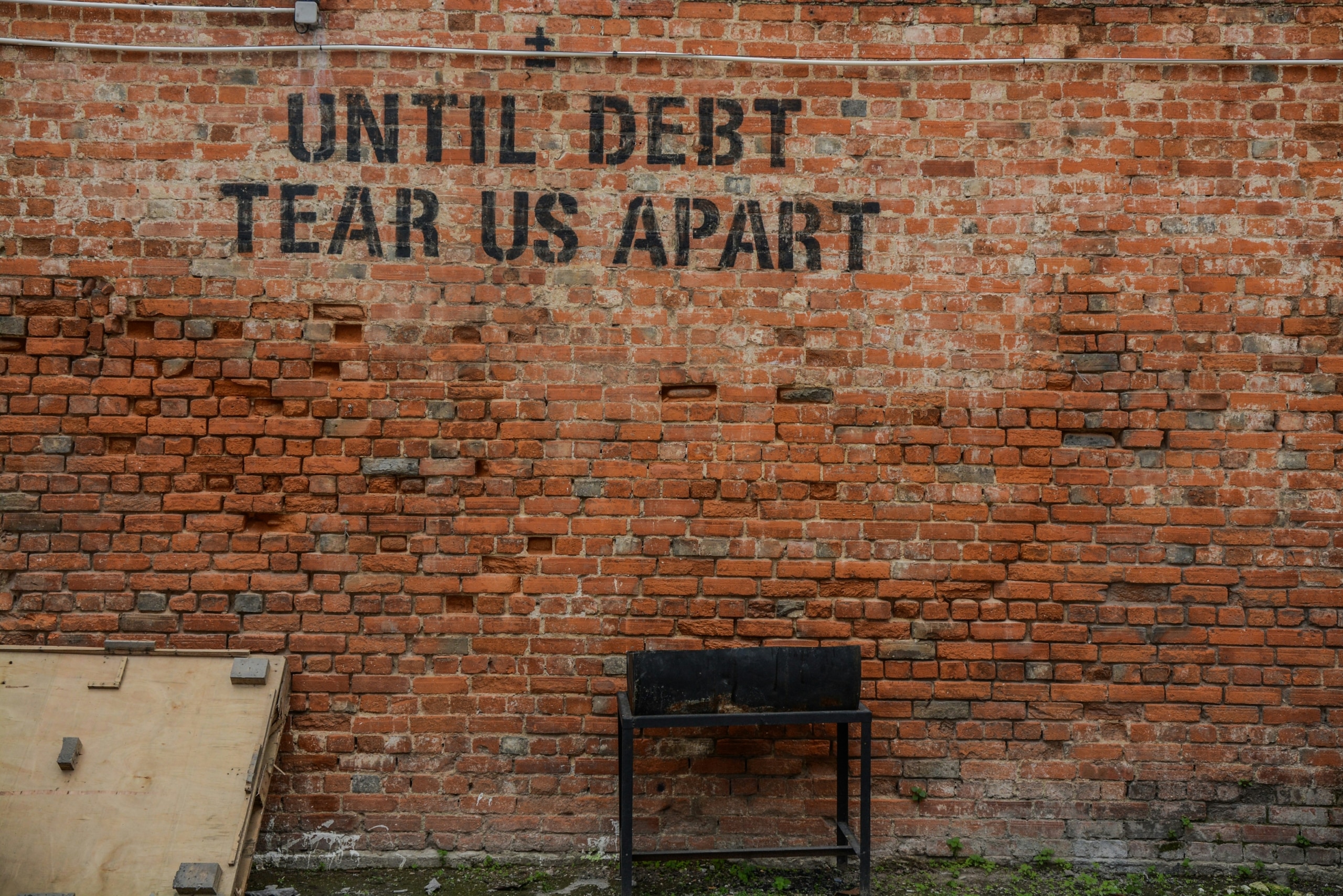

Acknowledging the Problem: Taking the First Step

Confronting the harsh reality of debt is often the most challenging yet crucial step towards regaining financial stability. Avoiding or denying the issue only exacerbates the stress and financial strain. It is imperative to face your financial situation directly, as this provides the foundation necessary for developing a successful debt management strategy.

Understanding that debt is a common and widespread issue can alleviate some of the shame or embarrassment that may accompany it. Many individuals, regardless of their income or background, stand at the crossroads of financial distress. Recognizing that debt is not a personal failing but a complex problem that can be managed gives you the mental clarity to move forward.

Acknowledging your debt involves a candid assessment of your current financial status. This includes listing all debts, understanding interest rates, and getting a clear picture of how much you owe. By laying everything out, you dismantle the overwhelming feeling and begin transforming chaos into structured, manageable information. This transparency is the cornerstone for creating an effective action plan.

Converting feelings of overwhelm into actionable steps starts by admitting to the problem. This might involve having difficult conversations with loved ones, reaching out to financial advisors, or using digital tools designed for debt management. These initial steps will help set the stage for a motivated and actionable plan, driving you towards financial recovery.

Moreover, by acknowledging your financial problem, you also open the door to resources and support systems. Financial counseling services, debt consolidation strategies, and budgeting applications are just a few examples of aids that become accessible once you accept your financial state. These resources can guide you through the process of debt repayment, budgeting, and building a foundation for future financial health.

Assessing Your Debt: Understanding the Full Picture

To regain financial stability, the first crucial step is assessing your current financial situation comprehensively. This begins with compiling a detailed list of all your debts, encompassing credit cards, personal loans, student loans, mortgages, and any other liabilities. Creating this inventory provides a clear visual of what you owe and can be a powerful motivator for taking control of your finances.

The significance of knowing the interest rates, minimum payments, and due dates associated with each debt cannot be overstated. Each of these elements plays a critical role in formulating a repayment strategy. For instance, understanding the interest rates helps prioritize debt payments, targeting those with higher rates first to minimize long-term costs. Similarly, being cognizant of due dates ensures timely payments, thereby avoiding late fees and additional interest charges.

To compile this information effectively, consider leveraging various tools. Budgeting apps such as Mint or YNAB (You Need a Budget) can be instrumental in tracking and managing debts. These apps often sync with your financial accounts, providing real-time updates and comprehensive reports. Additionally, spreadsheets in programs like Microsoft Excel or Google Sheets offer a customizable approach to organizing your debt information. You can create columns for each type of debt, listing out the owed amounts, interest rates, minimum payments, due dates, and any other pertinent details.

Accurately assessing your debt represents the foundational step on the path to financial stability. It establishes a baseline from which you can measure progress and make informed decisions. This process might seem overwhelming initially, but breaking it down into manageable tasks can simplify the endeavor. With a clear and detailed understanding of your financial obligations, you are better positioned to formulate a realistic and effective debt management plan.

Creating a Realistic Budget: The Foundation of Financial Recovery

Establishing a realistic budget is a critical step on the road to financial stability. A well-crafted budget provides clarity on your financial situation and serves as a strategic plan to manage income, control expenditures, and prioritize debt repayment. The foundation of any effective budget begins with a clear understanding of your financial landscape. This involves recording all sources of income and itemizing every expenditure.

The first step in creating a robust budget is to list all your income sources, including salaries, freelance work, and any other regular earnings. Next, it’s essential to categorize your expenses. Segregate your spending into fixed costs (like rent or mortgage payments) and variable expenses (such as groceries, utilities, and entertainment). Tracking every outgoing payment helps in detecting patterns and areas where reductions are feasible.

Prioritizing essential expenses is crucial. Costs such as housing, utilities, groceries, and transportation should top your list, ensuring that these necessities are always covered. Once these are accounted for, identify discretionary spending that can be reduced or eliminated. Look for non-essential expenses where adjustments can be made; dining out, subscriptions, and impulse purchases are common areas where cuts can yield substantial savings.

Allocating funds specifically for debt repayment should be a key component of your budget. Setting aside a dedicated portion of your income to pay down debts not only reduces your financial liabilities but also helps in improving your overall credit score. Consider employing debt repayment strategies like the debt avalanche or debt snowball methods, which can create a more systematic and psychologically rewarding path to becoming debt-free.

In today’s digital age, numerous tools and applications are available to simplify the budgeting process. Apps like Mint, YNAB (You Need A Budget), and PocketGuard offer intuitive interfaces to track expenses and manage finances efficiently. These platforms can automate much of the tracking process, provide visual representations of spending habits, and send alerts for overspending, thus making budgeting more sustainable and less daunting.

Developing a Debt Repayment Plan: Strategies for Success

When facing financial instability due to debt, creating a structured repayment plan becomes essential. Among the most recognized strategies, the Snowball Method and the Avalanche Method offer unique approaches tailored to different financial situations.

The Snowball Method focuses on paying off the smallest debts first. This strategy can provide a psychological boost as the debtor sees accounts being closed one by one, which helps to build momentum. Begin by listing all debts from smallest to largest, making minimum payments on all but the smallest. Direct any extra funds to the smallest debt until it’s fully paid off. Then, move on to the next smallest debt. While this method may result in paying more interest over time, the quick wins keep motivation high.

Conversely, the Avalanche Method targets the debt with the highest interest rate first. This approach can significantly reduce the amount of interest paid over the life of the debt. Start by listing all debts according to their interest rates, from highest to lowest. Make minimum payments on all debts except the one with the highest interest rate, directing any extra funds to pay it off quickly. Once the highest interest debt is cleared, proceed to the next highest. Although progress may seem slower initially, the financial benefits can be substantial over time.

Choosing the right repayment strategy depends on individual circumstances. Those who need continuous motivation may find the Snowball Method more beneficial. Conversely, those who are driven by minimizing financial cost and can stay the course despite slower progress might prefer the Avalanche Method.

Regardless of the chosen strategy, consistency and commitment are key. Setting realistic, achievable goals can aid in maintaining focus. Automate payments whenever possible to ensure consistency. Additionally, regularly review and adjust the plan as necessary, celebrating milestones along the way to stay motivated.

Ultimately, regaining financial stability requires a personalized and dedicated approach to debt repayment. By thoughtfully selecting and adhering to a strategic plan, overcoming debt becomes an attainable goal.

Negotiating with Creditors: How to Seek Better Terms

When faced with overwhelming debt, proactively engaging with creditors can be a pivotal step towards regaining financial stability. Effective negotiation can lead to lower interest rates, adjusted payment plans, or even debt forgiveness. Here’s a step-by-step guide on how to approach these crucial conversations:

1. Assess Your Financial Situation: Begin by carefully reviewing your financial status. Take into account your income, expenditures, and the extent of your debt. Having a clear understanding of your financial landscape will prepare you for discussions with creditors, enhancing your ability to present a well-informed case.

2. Gather Necessary Documentation: Before initiating any negotiation, amass all pertinent financial documents. This includes recent pay stubs, bank statements, expense reports, and current debt records. Having these documents readily accessible will demonstrate your preparedness and commitment to resolving your debt issues.

3. Contact Your Creditors: Reach out to your creditors directly, ideally before your payments fall significantly behind. Explain your situation honestly and request to discuss alternative payment options. Be polite yet assertive; clarity and transparency are key.

4. Propose a Repayment Plan: Suggest a repayment plan that reflects your current financial capabilities. Discuss potential adjustments, such as extended repayment periods or reduced interest rates. Be realistic in your proposals, ensuring that they align with your financial resources.

5. Negotiate Debt Forgiveness: In some cases, creditors may be open to partially forgiving your debt. While this is not always guaranteed, demonstrating severe financial hardship might incline some creditors to negotiate a settlement. Clearly articulate your financial constraints and the necessity for leniency.

6. Seek Professional Assistance: If negotiating directly with creditors feels daunting, consider working with a credit counselor or a debt management agency. These professionals can provide valuable guidance and may negotiate on your behalf to secure better repayment terms.

7. Document Agreements: Ensure that any agreements reached are documented in writing. This provides a tangible record of the new terms and helps prevent future misunderstandings.

Approaching creditors for better terms requires preparation, clarity, and persistence. By methodically following these steps and possibly seeking professional help, you can navigate the negotiation process more effectively, taking crucial strides towards financial stability.

Generating Extra Income: Boosting Your Financial Resources

Supplementing your income is a pivotal step towards swiftly repaying debt and achieving financial stability. There are myriad ways to boost your financial resources, each catering to differing skills and time commitments. Freelancing, for example, offers a flexible way to earn extra money by leveraging your existing skills. Whether it’s writing, graphic design, or programming, numerous platforms connect freelancers with clients seeking specific services. Additionally, part-time jobs can provide a steady stream of supplementary income. Moreover, the gig economy has opened up varied avenues such as ride-sharing, food delivery, or pet sitting, which can be easily managed alongside your primary job.

Furthermore, selling unused or unwanted items can generate quick cash. Platforms like eBay, Craigslist, or Facebook Marketplace facilitate the sale of everything from electronics to clothing. This not only declutters your living space but also provides an immediate financial boost. Income-generating ideas must, however, be realistic and align with your current responsibilities. Balancing extra work with daily life is critical to avoid burnout. For instance, freelancing or gig jobs with flexible hours can be balanced with full-time employment or personal commitments.

Other creative avenues for generating income include starting a side business, such as offering online courses, virtual tutoring, or crafting handmade goods. Passive income sources like investing in dividend stocks or rental properties can also be considered, although these often require an initial capital investment. It’s important to assess the feasibility and potential of various options to find the right fit for your lifestyle.

In essence, diversifying your income streams by exploring various methods can significantly enhance your financial standing. Pursuing additional income avenues, while mindful of your existing responsibilities, ensures a balanced and sustainable approach to alleviating debt. The key is to identify opportunities that not only align with your skills and interests but also complement your schedule and long-term financial goals.

Adopting Mindful Spending Habits: Long-Term Financial Health

Mindful spending is a pivotal practice in regaining and maintaining financial stability. It involves a thorough evaluation of our expenditure habits, aiming to discern between essential needs and mere wants. By consistently prioritizing necessities over desires, individuals can significantly reduce frivolous expenses and avoid the pitfalls of impulsive spending.

To start, consider creating a well-defined budget that segregates your income into essential categories such as housing, utilities, groceries, and transportation. This approach ensures that primary expenses are covered before allocating funds to non-essential items. Another vital aspect of mindful spending is to cultivate the habit of delayed gratification. This means allowing time to pass between wanting something and actually making the purchase. Often, the urge to buy diminishes after a cooling-off period, thereby preventing unnecessary expenditures.

Frugality also plays an instrumental role in maintaining long-term financial health. Being frugal does not imply a miserly lifestyle but rather a mindful approach to spending, focusing on obtaining the best value for money. For example, taking advantage of discounts, shopping during sales, and comparing prices can lead to substantial savings over time.

Additionally, avoiding impulsivity when spending is crucial. Impulsive purchases, driven by emotional triggers or marketing tactics, often lead to financial regret. To counter this, develop a habit of listing potential purchases and revisiting them after a set period. This practice can offer clarity on whether the purchase is genuinely necessary or simply a fleeting desire.

Financial discipline is integral to sustaining long-term monetary health. Regularly reviewing and adjusting your budget, setting financial goals, and monitoring progress can cement a stable financial foundation. Implementing these measures fosters a proactive approach towards managing finances, minimizing debt recurrence and promoting fiscal responsibility.

Adopting these mindful spending habits is not just a short-term solution but a sustainable strategy for long-term financial health. By making a concerted effort to differentiate between needs and wants, delay gratification, and practice frugality and financial discipline, one can pave the way to regaining financial stability and preventing future debt issues.

Seeking Professional Help: When to Consider Financial Advising

Regaining control over one’s financial situation often necessitates seeking professional financial advice or debt counseling. When personal efforts to manage debt prove inadequate, and stress about finances becomes overwhelming, it may be prudent to consult a financial advisor. These professionals can offer specialized knowledge and strategies tailored to an individual’s financial circumstances, thereby accelerating the journey toward financial stability.

Engaging with a financial advisor or debt counselor provides several benefits. Primarily, they can assist in creating a comprehensive debt management plan that includes budgeting, debt repayment strategies, and long-term financial planning. Advisors employ their expertise to analyze your financial status, identify problem areas, and suggest viable solutions. Additionally, their objective guidance can mitigate emotional decision-making, a common pitfall when stress levels are high.

The cost of financial advising services can vary significantly, from hourly fees to fixed rates for specific services. While private financial advisors may charge between $150 and $300 per hour, some may offer packages tailored to specific financial needs. Nevertheless, for those unable to afford these rates, non-profit organizations often provide free or low-cost financial counseling. Organizations such as the National Foundation for Credit Counseling (NFCC) and the Financial Counseling Association of America (FCAA) offer accessible services to individuals struggling with debt. These non-profits employ accredited counselors who can assist in devising customized debt management plans, negotiate with creditors, and offer ongoing support throughout the debt repayment process.

Finding a reputable financial advisor involves thorough research and due diligence. It’s advisable to seek recommendations from trusted sources, check credentials such as Certified Financial Planner (CFP) certification, and verify their standing with professional organizations like the CFP Board. Non-profit counselors should be vetted similarly, ensuring their credentials and affiliations reflect a commitment to ethical, client-focused financial guidance.

By leveraging the expertise and resources available through professional financial advisors or non-profit organizations, individuals can navigate the complexities of debt management more effectively and work toward a sustainable financial future.